Import duties and VAT

What to Know Before Importing a Vehicle

When you import a car or other vehicle from outside the EU—such as the USA, Canada, the Middle East, or Switzerland—you’re liable to pay import duties and VAT once the vehicle is cleared by Dutch Customs. We’re happy to map out the import costs for you. Learn more about our full customs-clearance process.

Many first-time importers are surprised by the costs and formalities involved. That’s why it’s important to get clarity on expected taxes in advance. At SCL Rotterdam, we ensure you know exactly what to expect. We calculate the correct amounts and submit the declaration on your behalf.

If importing from an EU country within the Customs Union, this falls under free circulation of goods. There are no import duties and usually no VAT. You still may owe BPM (Dutch registration tax) for a Dutch license plate.

Want to know more about BPM and registering on Dutch plates? Find out more on our BPM calculation & declaration page and registration page.

What are Import Duties?

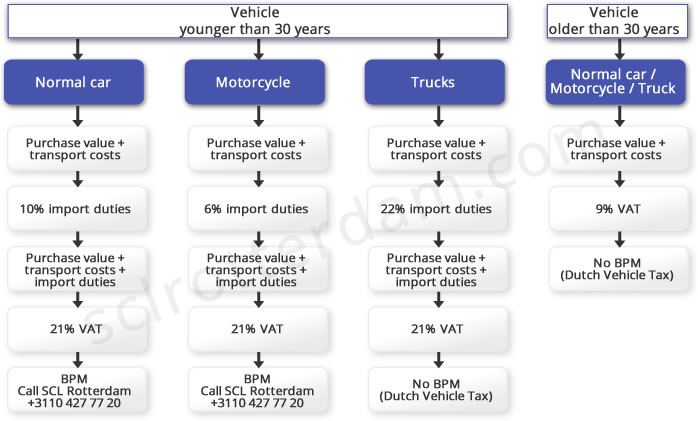

Import duties are taxes on goods derived from outside the EU. The rate depends on the type and value of the goods. For vehicles, duties can range from 0% to 22% of the value. For vehicles older than 30 years (classic cars), import duty is zero. For regular passenger cars, it's 10%.

For commercial vehicles (e.g. vans, pickups), the rate is 22%. Some Chinese vehicle models may face additional duties.

Most vehicles from the USA or Japan are treated as passenger cars with a 10% rate. For classics, we submit a classic-car declaration so you qualify for 0% import duty and reduced VAT.

Note that for some Chinese vehicles, additional import duties apply on top of the standard rates.

Calculating your vehicle’s import duties

We assist in calculating import duty so you know exactly what to expect. Our specialists use official exchange rate tables, purchase invoices, and transport documents to make precise calculations.

Importing from outside the EU also incurs VAT on the vehicle value, including import duty and all related costs. In the Netherlands, the VAT rate is 21%. We help calculate the VAT due on import.

Already Bought Your Vehicle? If you already purchased a vehicle abroad and want to know import duty and VAT owed upon its arrival in the Netherlands, get in touch—we’ll provide a free cost estimate.

Moving and VAT Exemption

If your vehicle is part of your household goods during relocation, we can often apply for a VAT and duty exemption. In 99% of cases, we successfully clear relocation vehicles without duties or VAT. We assess the situation in advance so there are no surprises.

*Note: Occasionally, VAT may apply even within the EU if Customs classifies the vehicle as “new” (e.g., low mileage or recent registration abroad).

Avoid surprises—contact one of our import specialists if in doubt! We interpret the rules and honestly advise what is possible. At SCL, you always speak to someone who knows the process and acts fast with clear answers.

Why Choose SCL for Import Duties & VAT?

We manage the full process from calculation to declaration

Tailored solutions for your specific vehicle and situation

Declarations processed in the same business day (if documents are complete)

Personalized service with real-time portal access

Thousands of private clients successfully imported and cleared vehicles

Curious what you will owe in duties and VAT? Or whether your vehicle qualifies for relocation or classic-car exemptions? Contact us for a free consultation.

.png?resolution=115x0&quality=95)